Zing Cover

Insurance You and Your Customers Will Love

BRAND AFFINITY.

Your customers have made an intentional choice of product and retailer. We respect this and give your customers the confidence of knowing that we will work with you when it comes to claims.

ENGAGEMENT.

Your customers' insurance should stay relevant, so we will work with you to keep our members insurance valuations, product care and maintenance up-to-date.

REVENUE

We only accept members by referral from our partner retailers. Because we don't spend our members' money on expensive marketing campaigns we can share our profits with our partners.

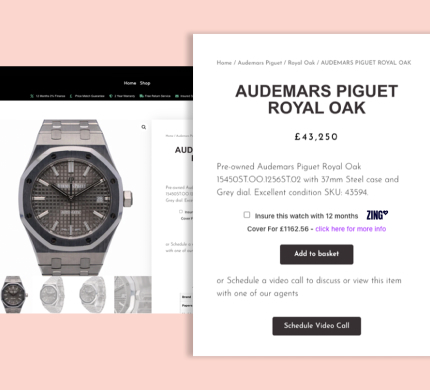

ONLINE.

Dynamically priced insurance displayed at the product review page and instantly available to add to the checkout basket with a single click.

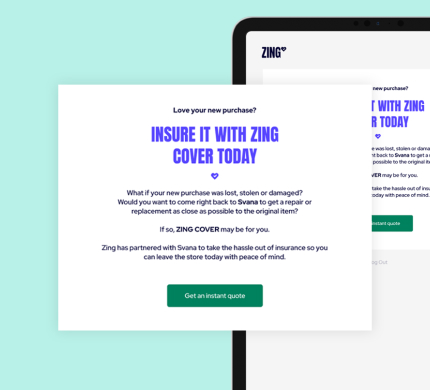

IN-STORE

Your customers ensure their new purchases are instantly covered before they leave your store through a Zing tablet.

Offer your customers insurance for their recent or historic purchases, along with valuation updates, maintenance tips or upgrade offers.

Just Some of Our Latest Partner Brands.

Boost conversion, customer engagement and revenue with ZING